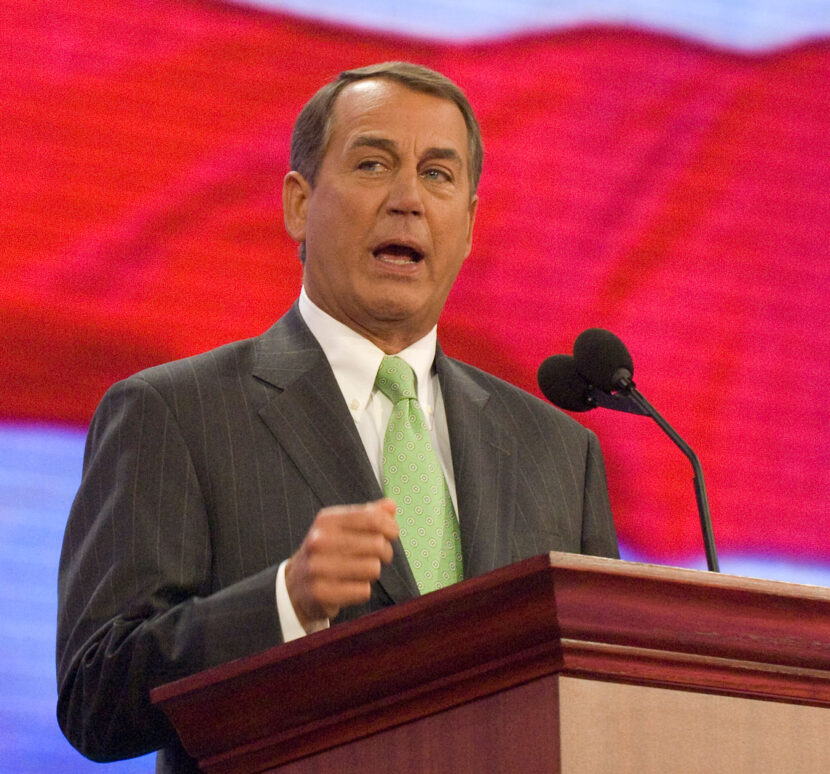

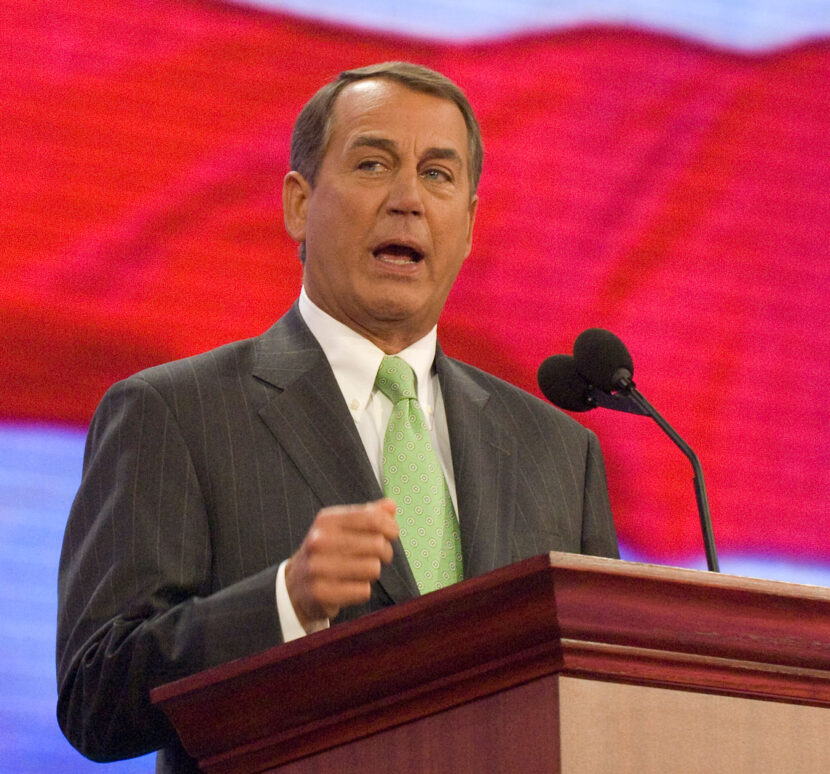

John Boehner represents Ohio's 8th District in the U.S. House of Representatives. He also holds the role of Speaker of the House. Members of the House must run for office every two years.

McGraw-Hill Companies, Inc./Jill Braaten, photographer

Facing the Fiscal Cliff

Now that President Obama has secured a second term, he is busy facing an immense challenge known as “the fiscal cliff.” In short, the president and Congress have less than two months to work together to curb the United States government debt that currently equals $16 trillion.

When officials and lawmakers bring up the “fiscal cliff,” they are talking about what could happen if two laws are allowed to go into effect after the first of the year without any intervention. The first is allows the Bush tax cuts to expire; the second is “sequestration,” a requirement that across-the-board spending cuts go into effect. The combined impact of higher taxes and deeps cuts will reduce the deficit but may also have an negative effect on the economy.

A Closer Look at the Twin Effects

A combination of two laws passed in 2001 and 2003, the Bush tax cuts refer to changes in the U.S. tax code that brought down the rate in the highest tax bracket from 39.6 percent to 35 percent.

These cuts have created a great deal of controversy. There is disagreement over the way the laws were passed, whom they benefited, and their overall effectiveness. Both tax laws included provisions that the cuts expire at the end of 2010. At that time, they were extended for two more years and are now set to expire at the end of 2012.

In 2011, Congress passed the Budget Control Act of 2011. The Act called for a “super committee” (officially called the Joint Select Committee on Deficit Reduction) to create legislation to reduce the deficit by $1.2 trillion over the span of ten years. If the committee did not do this, the act called for automatic cuts in domestic and defense spending. The committee did not create such legislation s0 the cuts are scheduled to happen.

While taxes and spending cuts are the main factors, they are not the only ones.

The expiration of a 2 percent Social Security tax, the continuing of unemployment benefits, as well as new taxes to fund the Patient Protection and Affordable Care Act (also known as Obamacare) could also factor in to additional fiscal challenges.

While taxes and spending cuts are the main factors, they are not the only ones. The expiration (ending) of a 2 percent Social Security tax, the continuing of unemployment benefits, as well as new taxes to fund the Patient Protection and Affordable Care Act (also known as Obamacare) could also factor in to additional fiscal challenges.

There was a lot of talk during the campaign about the Republican and Democratic parties putting aside their differences and working together for the common good of the American people. This issue will be a true test of bi-partisan cooperation as neither side wants to see a collapse of budget policy and be seen as responsible for another recession. Speaker John Boehner made a statement that said that “fiscal imbalance” will not be able to be solved overnight. However, he hinted at the possibility of a compromise if the president agreed to tax reform. One solution is to close up tax loopholes. The fact that negotiations will take place during a lame-duck Congress will complicate matters.

Help Outside of Washington

In his election night speech, President Obama identified avoiding the “fiscal cliff” as one of four key objectives of his second term (the three others are tax reform, energy independence, and immigration reform). In an effort to rally support in the private sector, he met with the Fix the Debt Coalition, a group made up of 80 corporate executives, many of whom supported Mitt Romney. Their goal is to push for a budget compromise, persuading Republicans to accept higher taxes in exchange for reductions in entitlement programs like Medicare and Medicaid.

DIG DEEPER

Keep following this story into next year. Make note of the position of each side, follow the discussions, compromises, and the ultimate outcome of this potential crisis.

David Martin